In a digital era, it’s becoming a practice to switch to instant loan online service for banking needs organization. In reality, it is not simply a trend but a well-conceived move with a huge number of benefits. Let’s debunk the top reasons why getting a flexible online loan makes a lot of sense, given the volatile financial situation nowadays.

- Personalized Borrowing Experience:

Among the principal benefits of flexible and online loan choices is the potency of tailoring a borrower’s experience to their precise needs. Traditional lenders usually use the “one shoe fit all” principle, which makes it problematic to find loans that fit every situation. When users can apply loan online, they can deal with anything from loaning terms and schedules to loan types, all tailored to their specific financial reality.

- Rapid Access to Funds:

- The advantage of time is our most notable attribute in comparison with other types of financial resources. Our staff will provide all the necessary information to tackle the situation as quickly as possible. The speediness of online personal loan approvals, along with quick fund disbursal, is what digital loan service is proud of.

- Through online applications and automated approval systems, financially indebted borrowers can conveniently obtain the required funds within a short time, making it the most suitable option for crisis financial challenges.

- No Physical Restrictions:

Typically, brick-and-mortar banks have these limitations about structure, but online loans, by nature, are very flexible. Loan app users can experience the whole lending process, both from their living places or any other place online. Physical trips to the bank are no longer needed as they afford the same value, time, and effort, allowing individuals from a broad spectrum of society to be able to borrow.

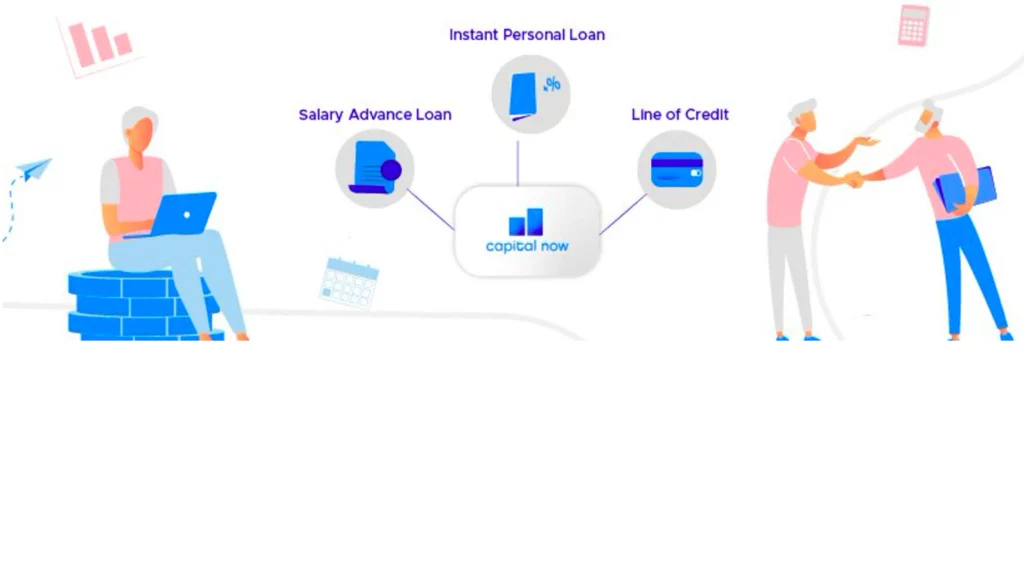

- Diverse Loan Products:

Flexible online loan options cover a whole range of loan products as well as serve different needs of a financial nature. Whether it is a payday loan for a two-week settlement, an installment loan, or a line of credit, borrowers have the advantage of flexibility in terms of selecting the loan type that fits their demands. In this way, individuals are able to identify a financial product that meets their goals and individual situations.

- Credit Score Flexibility:

Mainly, banks are all about credit score ratings, limiting people with not-so-perfect credit score history from securing loans. In addition to online flexible lenders, individuals with all sorts of credit scores can get several options from lenders offering loans online. Certain lenders specialize in using credit score alternatives such as income and employment backgrounds, among others, enabling some of the financing-deprived people to access financial assistance.

- Transparent Fee Structures:

Clear and understandable fee structures constitute an outstanding feature offered by reliable online lenders. Providing a borrower with a chance to review a loan’s detailed terms and conditions, such as interest rates and fees, before the agreement creates transparency. That will give the people a right to complete information, and this will enable them to make proper decisions, which will, in turn, contribute to financial literacy.

- 24/7 Accessibility:

Financial needs can strike at any time, and when you need them the most, the conventional banking system, with its lack of flexibility, may hamper you. Online loan instant options are available for 24/7, which is unlike before when people could only borrow when the bank was open. There will be users who can send applications for loans, log in to their accounts, and manage their debt repayments at any time. This solution gives a unique degree of comfort and convenience.

Take charge of your finances with the power of online loans! These flexible options cater to your unique needs, offering speed, accessibility, and clear terms. When navigating your financial journey, make informed decisions by researching and comparing your options.