Handling personal financial matters has become more essential than ever before in the increasingly tech-savvy world. Modern technology has created several choices for customers to take care of their finances. This article explores how current strategies and apps available today can help you with budgeting, saving, and preserving your hard-earned money.

The Power of Online Budgeting:

One of the breakthroughs in handling your finances is the accessibility of online budgeting apps. These apps offer several advantages over old traditional methods:

- Real-time tracking of expenses

- Automatic categorization of spending

- Visual representations of financial habits

- Easy access from multiple devices

- Customizable alerts for overspending

Choosing the Right App:

With various alternatives available, picking the right budgeting app can seem intimidating. Consider the following factors for finding the right app for you:

- User interface and ease of use

- Integration with bank accounts and credit cards

- Customization options for budget categories

- Goal-setting features

- Security measures to protect financial data

- Availability of customer support

- Cost and subscription plans

The Rise of Rocket Money Management:

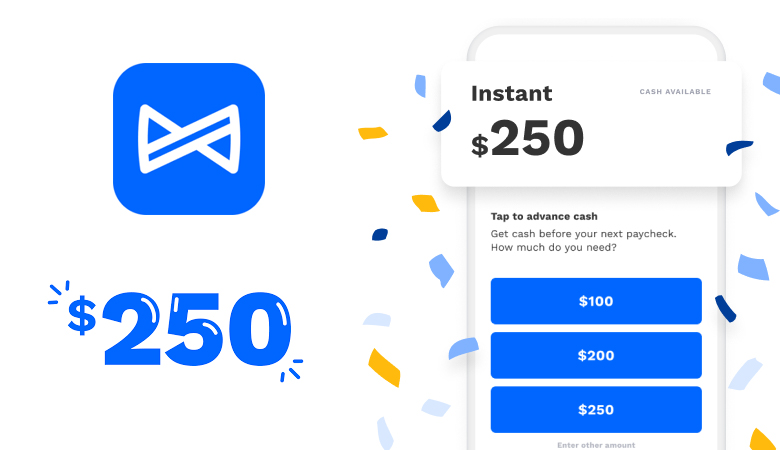

In recent years, a new generation of financial management apps has evolved, frequently referred to as “rocket money“. These comprehensive solutions offer:

- Automated savings features

- Investment opportunities

- Bill negotiation services

- Subscription tracking

- Credit score monitoring

- Identity theft protection

Leveraging Save Money App Features:

Many modern financial apps go beyond basic budgeting, offering features specifically designed to help users save money. Some key functionalities of a save money app include:

- Round-up savings on purchases

- Automated transfers to savings accounts

- Personalized savings challenges

- Cash-back rewards on everyday spending

- AI-powered recommendations for reducing expenses

- Debt payoff strategies and calculators

These features can make saving money feel effortless, helping users build their financial cushion without significant lifestyle changes. By gamifying the saving process, these apps encourage users to develop better financial habits over time.

The Integration of Online Banking:

The evolution of online banking has transformed how we handle our finances. Modern banking apps offer:

- Instant fund transfers

- Bill pay services

- Mobile check deposits

- Spending insights and alerts

- Virtual card creation for secure online shopping

- Integration with popular payment apps

Internet banking effectively integrates with budgeting and saving apps to provide a complete solution to financial management. This integration enables more accurate tracking of spending and income, leading to better financial decision-making.

The Future of Personal Finance Management

As tech continues to upgrade, we expect even more dynamic solutions in the domain of personal finance. Some emerging trends include:

- AI-powered financial advisors

- Blockchain-based budgeting tools

- Voice-activated financial assistants

- Augmented reality for visualizing financial data

These developments promise to make financial management even more accessible and intuitive for users of all backgrounds.

Conclusion:

Digital tools have become essential friends in our search for financial stability and growth as we negotiate the complexity of contemporary banking. From online budgeting apps to extensive money management apps, these developments provide strong methods to take charge of our financial futures. By embracing new technology and implementing wise financial tactics, we can pave the road for a more secure and successful tomorrow.