The stock market is full of hidden opportunities. To gain the best outcomes, an investor must identify the optimal trading time. If you are new to trading, you should get advice from a professional. Previously, only the wealthy could afford to hire a broker. These agents were known as full-service stockbrokers.

In addition to exchanging services, they provide tips. It provides finance guidance and trends to its consumers. Then, gradually, the number of discount agents rose. People who help trade stocks at a cheaper cost than full-service traditional agents. When the concept of zero broking was introduced, the number of traders who expressed an interest increased considerably.

Benefits of zero brokerage demat account:

A trader’s investment motto is to decrease expenditures while increasing revenues. In recent years, a zero brokerage Demat account has grown quite popular. Investors who use these accounts can benefit from a variety of benefits without having to pay the regular trading commission costs. Now, let’s examine the five advantages of trading without a brokerage.

Cost Savings:

The most obvious benefit of a zero-broking trading account is the lack of commission costs. Previously, traders had to pay their broker a fee for each successful deal, which might add up fast over time, particularly for busy traders. Zero-broking accounts allow investors to buy and sell stocks without paying fees, which can save a significant amount of money over time. Traders who decrease expenditures can boost their total investment returns and keep a bigger share of their profits.

Access to fractional shares:

Several zero-broking platforms allow investors to acquire a part of a stock rather than the entire share. This approach is especially useful for people looking to diversify their portfolio with pricey companies and those with limited cash. Investing in fractional shares helps investors distribute their money more effectively and exposes them to a broader range of assets without needing large initial investments.

Increased Trading Frequency:

When commissions are not a hardship, investors are more inclined to execute trades on a regular basis. Because of the increased trading frequency, traders are better positioned to capitalize on trading opportunities and profit from short-term market movements. Zero broking accounts help investors capitalize on market volatility and maximize their earnings by allowing them to day trade, swing trade, or execute several transactions fast.

Simpler Investing Experience:

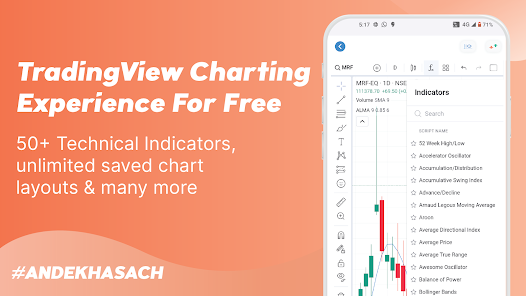

A zero broking online Demat account usually provides intuitive trading tools and user-friendly interfaces to make investing easier. These platforms provide easy access to market data, research papers, and analytical tools to aid in decision-making, independent of trader or investor skill level. Furthermore, zero broking businesses’ mobile trading applications let investors monitor their portfolios, conduct trades, and stay updated about market moves from anywhere and at any time, increasing convenience and flexibility.

Zero broking trading accounts and Margin Trading Facility provide several advantages, including cheaper expenses, more frequent trading, access to fractional shares, diversification opportunities, and so on. These accounts enable investors to increase earnings, optimize their trading tactics, and achieve their financial goals by eliminating commission costs and providing access to a variety of financial products.