Efficient financial management is the cornerstone of any successful small business. In today’s market, having a strong hold on your finances will not only help you ensure your business survives but also sets the foundation for growth. Whether you’re a startup navigating the initial challenges or an established small business aiming to streamline operations, understanding key financial strategies is important.

From budgeting and cash flow management to securing funding and managing debts, these tips can help you optimize your financial health. This guide will walk you through practical steps to take control of your business’s finances, enabling you to achieve your long-term goals.

Set a budget:

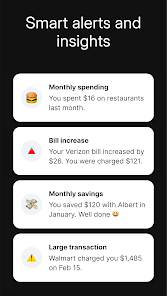

This tip works for both your personal and business financial management. Before setting up a reasonable budget, you need to study your past bills and see where your business spends money. Analyze this to see where all you can cut costs. Budgeting helps you closely analyze the money that you are making and the money that you are spending. This will prevent you from overspending and ensure you have funds available for necessary expenditures. If you are finding this tricky, use spreadsheets for budgeting apps like Albert and Every Dollar

Separate personal and business account:

Distinguishing between business and personal expenses is vital especially if you are a small business. Keep a separate business account and card that you will only access for business bill payments. If you don’t keep a separate business account, you might use business funds for personal expenses, so next time you need to spend for your business, you don’t have the necessary funds.

Cut cost and increase revenue

If you have a difficult time managing your business funds, look for ways that you can cut costs and increase your business revenue.

In order to cut costs, like we mentioned before, analyze your money expenditure. Cut costs where you can. Look for new vendors and compare their costs if needed. To increase revenue, offer discounts, use social media marketing or email marketing, try different cheaper strategies to reach an audience.

Cash Flow Management

Managing cash flow effectively ensures that your business has enough liquidity to cover business expenses. You can calculate your current cash flow by subtracting your business expenses from income based on when accounts payable due and accounts receivable are expected to come in. To promote a healthy cash flow, negotiate favorable payment terms with vendors and suppliers and encourage timely online bill payments from customers.

Tax management:

It is vital for you to pay your taxes on time. Keep a detailed record of all of your financial transactions and consider consulting with a tax professional to maximize credit and deductions. Properly managing your taxes not only saves you money but also reduces the risk of fines and audits.

Debt management:

Managing your debt is necessary for your business to grow and it has to be managed carefully. First pay off high interest debts to avoid financial strains. Regularly review your debt obligations and explore options like refinancing to reduce interest rates. Good debt management will help maintain a healthy credit score, which is essential for securing future financing.

Emergency Funds:

This has to be separate from your business savings account. Use these funds in emergencies or unexpected expenses. Aim to keep at least three to six months worth of operating costs. An emergency fund acts as a financial buffer, giving you the flexibility to navigate challenges without turning to high-interest loans or cutting essential services.

Monitor and Adapt

The financial landscape is constantly changing, so it’s important to regularly monitor your financial performance and adapt your strategies accordingly. Review your financial statements often, track Key Performance Indicators (KPIs), and be prepared to make adjustments as needed. This approach will help you stay ahead of potential issues and seize opportunities for growth.

Use Financial Management Tools:

Utilizing financial tracker apps can simplify managing your finances. From accounting software to invoicing tools, these resources can provide real-time financial insights, and help you make data-driven decisions. Investing in the right tools can save time, reduce errors, and enhance your overall financial management.

In summary, mastering financial management is crucial for the success and growth of your small business. By implementing these strategies— from budgeting to using financial management tools—you can ensure financial stability, make informed decisions, and position your business for long-term success in a competitive market.