In today’s digital era, managing money has become simpler and more accessible. With a range of tools and apps at hand, tasks like utilizing a credit card, moving money, and sending money online have never been simpler. There are several approaches and advantages to applying digital solutions to meet the efficient management of financial requirements.

Credit Card Bank Services

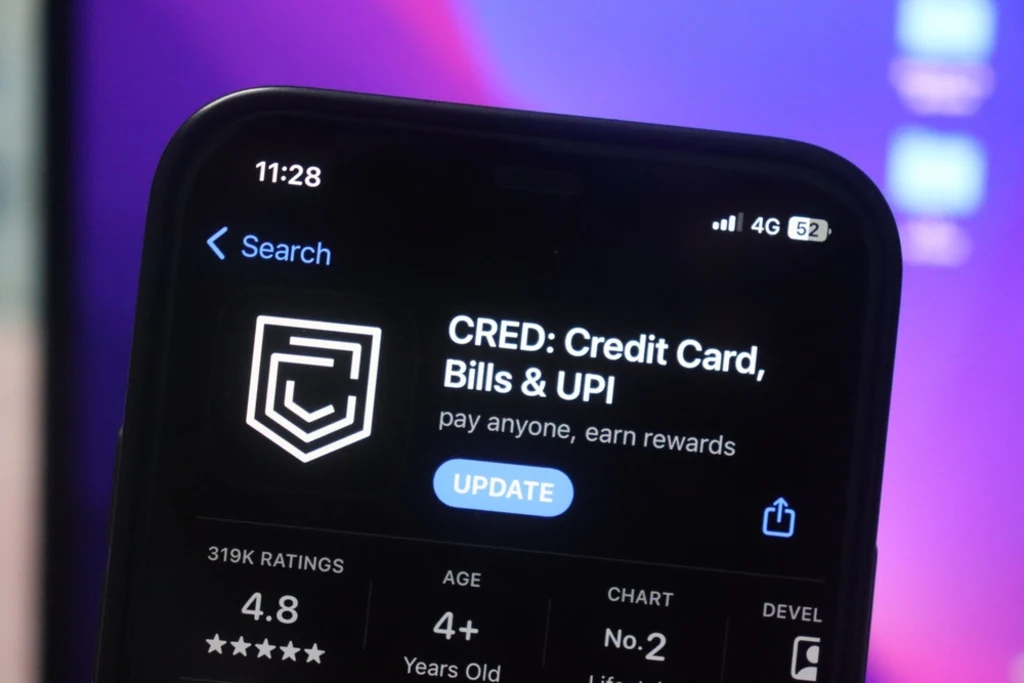

Digital banking tools offer unmatched ease in handling credit card bank accounts. Many banks let consumers manage their spending, make payments, and apply for new credit cards using mobile apps and internet portals. These services help you keep up to date with your finances, avoid missing payments or overdraft fines. These digital solutions also often provide customized financial advice, alert customers to maintain a good credit score, and more sensibly manage their money.

Send Money with Ease

Thanks to several digital channels, sending money has become easy. These sites provide quick and safe ways to send money, whether your transaction is personal or a bill payment. Since most apps permit quick transfers, handling your money on the run is simple. Furthermore, several of these systems let you create recurring payments, which are quite helpful for handling recurring costs like rent or subscription services.

The Convenience of Money Transfer Apps

Your financial management will improve if you use a transfer money app. These simple apps let you send money with just a few touches on your smartphone. Real-time alerts, transaction history, and the possibility to link several bank accounts—all of which help you to manage your money better—are common features. These apps also regularly interact with other financial services, including spending trackers and budgeting tools, thereby offering a complete solution for handling personal finances.

Send Money Online for Faster Transactions

Companies provide a dependable substitute for individuals who would rather use a computer to send money online. These systems may offer improved security tools to guarantee your transactions are safeguarded. Online services also frequently provide overseas transfers, enabling simple, low-cost money movement across boundaries. For companies involved in international trade or those with family members overseas, the ability to move money worldwide provides a convenient approach to handling cross-border transactions.

Send Money to Friends and Family

Digital options make it easier and faster to send money to friend. Money transfer apps let you send money right away, whether it’s for a birthday present or a restaurant bill split. Requesting payments, which simplifies the process of gathering money owed from others, is another function many apps provide. These applications give choices to include customized greetings or memoranda to transactions, personalizing the process of paying money to loved ones.

Transfer Money Seamlessly

Using digital financial instruments has several main advantages, predominantly being frictionless money transfer features. Whether you are changing it across your accounts or forwarding money to someone else, these services streamline your financial administration. Most systems offer either quick or same-day transfers, therefore saving time and effort associated with more traditional banking methods. Some tools also enable you to schedule future transfers, therefore giving you more control over your financial status and ensuring prompt payment of important expenses.

Key Benefits of Digital Financial Solutions

- Convenience: Manage your finances from anywhere, at any time.

- Speed: Instant transactions mean no waiting for funds to clear.

- Security: Advanced encryption and security measures protect your information.

- Cost Efficiency: Many services offer low or no fees for transactions.

- Accessibility: Support for multiple devices, including smartphones and computers.

Conclusion

Digital financial solutions have several advantages for effectively handling your money. These technologies offer security, speed, and ease whether your method of payment is a credit card bank service, send money app, or online cash transfer. Using these digital tools can help you simplify your financial management and guarantee that your money is always where you need it. Including these instruments in your regular financial operations not only streamlines the procedure but also offers more control and mental peace of mind. The future of financial management seems increasingly bright as technology develops and presents even more creative answers to satisfy your wants.